Final Report

Effects of Longwall Mining

On Real Property Value and the Tax Base

of Greene and Washington Counties, Pennsylvania

Commonwealth of Pennsylvania

Department of Environmental Protection

Bureau of Mining and Reclamation

Contract No. BMR-00-02

Prepared by

Jeffrey R. Kern, MRP, ASA, State Certified, General Appraiser

David Falkenstern, MS, Project Manager

Ronald W. Stingelin, Ph.D., Registered Professional Geologist

November 8, 2002

TABLE OF CONTENTS

1.2 Mining Methods and Mine Subsidence

1.3 Coal Ownership, the Estate of Coal, and the Right to Subside

2.4 Pittsburgh Coalbed – A Geologic Description

2.5 Status of Longwall Mining in Southwestern Pennsylvania

4.0 SALE AND COUNTY VALUE OF LONGWALL AND NON-LONGWALL PROPERTIES

4.2 Sale and County Value Comparisons

4.2.2 Control Area Selection Methodology

5.0 ANALYSIS OF ASSESSMENT CHANGES RELATED TO APPEALS

5.2 Long- Term and Short-Term Assessment Changes

5.2.3 Longwall Mining Damage and Compensation Process

6.0 STUDY OF TAX REVENUES FROM COAL MINING

7.0 LONGWALL ANECDOTAL INFORMATION (MEDIA REPORTS)

This study was designed to determine if longwall coal mining has had an effect on residential property values, and the real estate tax bases of Greene and Washington Counties. In short, the study is intended to determine if there are broad relationships between longwall mining and the:

● Assessed value of residential properties.

● Sale prices of residential properties.

● Tax revenue available to the county

Since the research was intended to discover overall trends or common factors, the effort used generalized information (averages, approximate location, etc.) to examine these issues. Conclusions developed by the study are, therefore, general in nature. Individual properties may or may not conform to the following overall trends:

● There is a relationship between location with respect to longwall mining and the assessed valuation as determined by the county.

● There appears to be no consistent relationship between the sales price of properties and presence of longwall mining.

● There is a relationship between the number of assessment appeals and the amount of assessment appeals and longwall mining. While most property owners do not appeal taxes, more appeal in longwall areas than in similar non-longwall areas.

● Taxes generated from longwall operations exceed the tax reductions granted to surface properties overlying longwall mines.

● Total compensation (including damage and incidental expenses) provided by the coal companies for surface damage exceeds the total value reductions determined in assessment appeals. The experience of individual properties may vary.

The analysis period of 1993 to 2002 was selected to represent a period of significant mine development, to capture assessment appeals and assessment changes, to capture residential property sales, and to capture compensation claims and payments. With the exception of compensation records all analysis is based on available public records including:

● Property assessment records

● Sales records

● Historic mining records and maps

In addition, confidential coal company reimbursement records were examined. A confidentiality agreement was used to allow the review of a portion of the records.

To complete the study, value as recorded by the individual counties had to be standardized. County assessment records show an assessed value as of the date of the assessment. The assessed value of property is related to an approximate market value (the value a property ought to sell for) by way of the assessment ratio. Each county uses different pre-established assessment ratios. These ratios are checked by the counties and the state each year to determine a “current ratio”. For this study the assessed value was divided by the current ratio to estimate or imply a “county value” – a rough approximation of market value. This allowed the analysis to compare information across county lines and to compare tax revenue gained or lost by assessment appeal results and coal mine development. It must be emphasized that “county value” is used to make comparisons among groups of properties by type and location, it does not represent the fair-market-value of individual properties.

In summary: The study indicates that there is a much stronger correlation between the county value of residential properties and access to public utilities (sewer and water) than between the county value and proximity to longwall mining.

The relationship between residential county value and mining is not consistent from place to place across either county. In contrast, the relationship between access to sewer and water is relatively consistent across both counties.

While undoubtedly the real estate truism: “value is derived from three factors – location, location, location,” is based in fact, in general, proximity to a longwall mine does not appear to be the major factor in determining “county value” and therefore assessed value. Other factors such as access to utilities (public sewer and water), proximity to major roads, density of residences, and the desirability of surrounding land uses appear more likely to influence the general taxable value (county value) of residential properties.

● The sales prices of residential properties sold during the study period was compared to the county value assigned to the property. The ratio of sales price to county value was compared to location with respect to longwall mining. There was no correlation between location with respect to longwall mining and the ratio of sales price to county value. Nearly the same proportion of properties sold for less than county value in the longwall areas as those that sold for less than the county value outside of the longwall areas. In fact, the proportions were nearly the same between longwall and non-longwall areas for properties selling for more than the county value and for properties selling at or near the county value.

● The statistical review did demonstrate that, on average, properties located above longwall mining operations are more likely to receive assessment reductions from County Assessment Boards than properties located elsewhere in the County. Obviously, the reduction in value granted by the counties reduces the taxable value of the individual parcels. However, the total reductions to date represent only a small portion of the tax base within the longwall mining areas. Less than half of the longwall related properties that were granted a tax reduction were later restored to the higher valuation. Over time this would appear to have resulted in the slightly average lower per acre county value in the longwall areas than in the non-mining areas of the counties.

● Of the records examined, coal companies typically pay more to the landowner for damages than the landowner is granted in county value reduction. The statistical review showed that the aggregate of coal company payments for damages exceeds the aggregate county value reductions granted by the assessment appeal boards. Comparison of county value reductions and individual damage settlements vary widely.

● County tax revenue generated by coal mining is significant. In Washington County longwall mine operators account for nearly 5% of the tax base. In the more rural Greene County, longwall operators account for nearly 30% of the countywide tax base. In southwest Washington and northwest Greene counties, longwall operators represent 50% of the local tax and school district bases.

● Longwall mining operations tend to be located in the more rural and remote sections of both counties. Thus, for the most part, the operations do not affect the more densely developed surface areas. As a result, while the operations cause subsidence and may cause significant damage to individual properties, the damages tend to be limited to a relatively small number of structures. On a per acre basis, the coal parcels associated with longwall mining operations are typically assessed at higher values than most other property types within these remote and rural areas in either Greene or Washington counties. In fact, active longwall mining coal parcels are assessed at twice or more per acre values than other mining and five to ten time the value of reserve coal tracts. For the most part, coal taxes are based on the market value of coal and the quantity of minable coal in place. The longwall mining operations are assessed at higher per acre values than other mining operations because there is more minable coal available. They are assessed at least five times higher than reserve coal tracts because reserve tracts are considered speculative and are not now generating income.

● To date, the annual property taxes generated from longwall coal mining has more than offset the annual tax revenue lost from those surface property assessment reductions related to longwall mining. However, unless the surface value is restored, this offset may be temporary. As the coal is mined, the taxable real estate value is depleted.

One of the issues identified for study was whether property values decrease in anticipation of mining – does the announcement of future mining cause a reduction of property values? Most mining area boundaries were established before the beginning of the study period (1993) making analysis of potential value changes related to the anticipation of mining difficult. Ideally, the analysis would involve paired sales – sales of the same property before and after the announcement of the mine plan. There were too few paired sales to complete this analysis. Instead, county records for the three year period prior to initiation of individual mine panels were searched to find assessment reductions that might be related to the anticipation of mining activity. These reductions could be indicators of a general relationship between future mining and a general unsupported opinion of value. There were not enough of these changes to reach any conclusions. Most assessment reductions were assigned after mining commenced.

Longwall mining causes surface property damage. The amount of damage to individual structures varies widely – with some structures receiving little measurable damage and others receiving substantial damage. The study showed that, overall, homeowners are receiving more in compensation than they are claiming as losses for property tax reductions. The study also showed that, overall, the receipt of compensation is not reflected in a restoration of taxable value to the counties - either the compensation is not being used to repair the properties or the counties are not often notified when repairs are completed. The study showed that there is no distinguishable correlation between the difference in sale values and assessments as they relate to the location of longwall mining. Other factors appear to affect value more significantly than mining – sewer, water, road access, etc. Finally, the taxes generated from longwall operations are significant but temporary.

Individual property experiences may differ from the overall trends identified in this study. To the extent that these individual experiences may be instructive they should be studied. In theory, properties that were granted reductions in assessment value due to damage caused by longwall mining should return to their original value after repair or compensation from the mining company. Just over 5,000 improved residential properties are located in the longwall regions of both counties. Of these, slightly under 3,000 are located in areas where longwall mining was active from 1993 through 2002. The vast majority of these properties did not file compensation claims or assessment appeals during the ten year period. In theory:

● Owners of Properties damaged by mining should file for and receive compensation

● Owners of Properties so damaged could also file for and receive either temporary or permanent tax relief (reduction in county value)

● The value of the compensation should somehow relate to the reduction in county value granted.

● Properties restored by way of compensation should return to or exceed the original county value.

As shown below, not all of the properties that received assessment reductions filed for claims and not all of the properties that filed for claims received assessment reductions. Only 95 of the properties received compensation and assessment reduction. Also as shown below, very few of the properties were ever returned to the original values (54).

401 Properties Noted as “Affected” by Longwall Mining By Assessment Appeals or Compensation Claims |

|||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

261 Properties: Assessed Value Reductions in Areas That Were Underlain by Longwall Mines |

|

235 Properties: Claims Filed Against Coal Companies During Same Time Period and Location |

|||||||||||||||||||

Of These: |

|

|

|

|

|

|

|

|

|

|

|||||||||||

166 Properties: Not Included in Coal Company Claims Lists |

|

140 Properties: Receiving Compensation Did Not Seek Property Assessment Reductions |

|||||||||||||||||||

|

95 Properties: Were Included in Both Data Sets; the Properties Were the Same |

|

|||||||||||||||||||

Of These: |

|

|

|

|

|

|

|||||||||||||||

|

20 Properties: Compensation less than the County Value Reduction |

|

|

75 Properties: Compensation Greater than County Value Reduction |

|||||||||||||||||

3 Years Later: |

|

||||||||||||||||||||

|

|

|

|

||||||||||||||||||

|

|

|

|||||||||||||||||||

41 Properties: County Value Restored to at Least Compensation Value |

|

54 Properties: County Value Not Restored |

|||||||||||||||||||

Future studies should focus on the evaluation of a subset of these 401 properties. The 95 properties where claims and assessment histories can be tracked could be studied in detail, if the home-owners and the coal companies agree to a releases of confidentially held settlement information. Additional studies might focus on:

● The rationale for not restoring the value to the original county value

● Not filing a compensation claim when an assessment appeal was filed

● Not filing an assessment appeal when a compensation claim was filed

This report will allow any future study to focus on specific issues at specific locations.

This report analyzes the effects that longwall mining may have on property values and tax revenues in Greene and Washington Counties, Pennsylvania. Section 1 of this report provides basic information about the terms and concepts discussed.

1.2 Mining Methods and Mine Subsidence

Throughout this report, we refer to two types of deep-mining methods that have dominated Pennsylvania’s underground coal mining: room-and-pillar mining and longwall mining. Before longwall mining was introduced, Pennsylvania coal miners used room-and-pillar mining to extract most of the deep coal produced in the state. Longwall mining was first used in Europe where it was found to be safer for miners and more efficient at extracting coal in mines where the equipment could be used. Today, longwall mining accounts for most of the coal produced in Pennsylvania. All of the currently active longwall mines in Pennsylvania are located in Greene and Washington Counties, where the Pittsburgh coal seam provides optimum conditions for using longwall technology.

Room and Pillar Mining

Room and Pillar MiningIn room-and-pillar mining, intersecting tunnels of varying width and length are mined throughout a coal seam. The method leaves a checkerboard effect of empty “rooms” (mined-out voids) and unmined “pillars,” which are blocks of coal left in place to prevent the ceilings of the rooms from collapsing on the miners. The pillars are essential to the further development of a typical room-and-pillar mine. Some of the protective pillars may be mined out (retreat mining) and some pillars may be left standing as mine operations end.

After a mine is closed (and often abandoned), pillars and ceilings can deteriorate over time from ground water flooding the empty rooms. When the pillars and ceilings rot, the rock above the ceilings can collapse without warning. As ceilings cave in, the downward movement of rock and soil can propagate up to the surface and cause subsidence, such as sinkholes or troughs. If a sinkhole, for example, is large enough, a house in its path can be damaged. Sinkholes and troughs may not occur above old room-and-pillar mines for 30 years or longer.

Sinkhole Subsidence

Sinkhole SubsidenceSinkhole subsidence is also known as pothole subsidence because of the deep and narrow holes (tens of feet in depth and in diameter) created as the earth subsides. Sinkholes usually occur when the ceiling of a mine room falls between pillars or when pillars collapse. Typically where sinkholes form, the mine is at a relatively shallow depth below the surface. Because old room and pillar mines have often been abandoned and the mine operator has gone out of business, DEP offers Mine Subsidence Insurance as a low-cost, long-term solution to handle this risk.

Trough Subsidence

Trough SubsidenceTrough subsidence looks more like a shallow and wide depression of a few feet deep and a 100 feet or larger in diameter. Troughs usually occur when pillars in an old mine deteriorate over a wide area causing larger roof collapses. Like sinkhole subsidence, trough subsidence over room-and-pillar mines usually occurs long after mining has ceased, but troughs can occur soon after pillars are removed during retreat mining. Troughs can be large enough to affect neighborhoods.

Longwall Mining

Longwall MiningIn longwall mining, pillar-supported hallways(entries) are carved into the coal seam and wide (600 feet to 1,000 feet) panels of coal to be mined with longwall mining machinery are left between these entries. The entries provide access and ventilation to the workers and to the equipment mining the panel. Along the face of the panel, a longwall machine digs out all of the coal in its path across the seam between the entries. The machinery incorporates a system of supports that cover it and prevent the ceiling of the mine from collapsing and burying it and its operators. As a longwall mining machine moves forward into the coal seam, however, its supports move with it, and the ceiling behind the supports, which is no longer supported, collapses. The movement of falling rock and debris can propagate up to the surface of the earth as a large subsidence trough and can cause damage to overlying property.

Trough subsidence is the predominant subsidence associated with longwall mining where wide and long blocks of coal are completely mined out. A typical longwall panel today may be 1,000 feet wide and 10,000 feet long. Most trough subsidence occurs concurrently with longwall extraction of the coal, but residual subsidence may occur several months to a year after mining. Complete subsidence may take a year or two, and may be affected by mining of an adjacent panel. Important to this study, subsidence from longwall mining occurs while the mine operator is still in business and is legally bound to pay for damage to the surface. Research on the effects of subsidence on manmade surface structures and on springs, wells, and streams is discussed in Section 2.3 of this report.

Recently published reports required of the Pennsylvania Department of Environmental Protection (DEP) expand on these discussions. The four illustrations shown in this section are taken from these reports. Pennsylvania law that requires the DEP to assess the surface effects of underground mining on structures, water supplies, and streams every five years. The study period began in 1993. To prepare the report, DEP compiled information on 1,884 properties that were undermined between August 1993 and August 1998. A supplement to this report was published in February 2001. The supplemental study revealed that subsidence damage from underground mining was reported on nearly half of the properties in the study area. Of these properties, 70% of the damages were resolved by the time the study was published. As required by law, the mine operators had provided temporary and replacement water supplies, repaired land and structure damage, and compensated property owners.

1.3 Coal Ownership, the Estate of Coal, and the Right to Subside

Who owns the coal beneath the surface of land in Pennsylvania? Who owns the rights to extract coal from beneath the surface? Why are coal companies allowed to extract coal in a manner that can lead to subsidence and surface property damage? The answers to these questions lie within Pennsylvania’s legal definitions of real property, which includes rights to the surface, support of the surface, and the subsurface, including underground coal.

Title to all real property (real estate) in Pennsylvania, if traced back to the original title, includes full ownership rights to both the surface and the subsurface. Over time, many owners of real estate chose to convey by sale or lease their rights to subsurface coal to others, including mining companies. Often owners also sold or leased their right to the support of the surface, which, in essence, conveyed the right to mine the coal. With these transfers of property rights, a mine operator could mine subsurface coal without further encumbrance. Without the right of support, a surface owner had little recourse when surface damages were caused by underground mining of the coal.

Before 1966, the rights to support of the surface were defined only in a property’s title, as described in a property deed. The Bituminous Mine Subsidence and Land Conservation Act of 1966 modified those rights and provided many homeowners with protections against subsidence damage, which were not contained in their deeds. However, many others were left without such safeguards.

In 1994, Act 54 amended the 1966 Act to require mine operators to compensate all homeowners for damages caused by their underground coal mining operations. At the same time, Act 54 removed most rights that surface property owners had to the support of the surface, thereby allowing mine operators to mine under and cause damage to almost any structures. By passing Act 54, the General Assembly of the Commonwealth intended both to protect surface property owners from economic loss and to provide the coal mining industry in Pennsylvania a means to remain competitive in the world market.

With this study, DEP is seeking to learn the following:

• How does longwall mining activity affect the value, in general, of homes on the overlying surface property?

• If longwall mining affects the value of homes on the overlying surface property, how does such mining affect the property taxes that Greene and Washington Counties collect from homeowners?

• If longwall mining affects the property taxes that homeowners pay, how do the taxes that coal companies pay offset any gains or losses from homeowners’ taxes?

• How does longwall mining affect the taxes that coal companies pay on mined coal and the remaining coal reserves?

• Does longwall mining impact the value of properties scheduled to be undermined?

Resource Technologies Corporation was engaged by the Pennsylvania Department of Environmental Protection to analyze and report the effects that longwall mining may have on the value of residential properties and on the property tax bases of Greene and Washington Counties, PA. Two methods were considered to conduct such a study.

Method 1. Evaluate individual properties on an in-depth basis. By definition, this procedure would focus on specific properties damaged (or claimed to be damaged) by longwall mining activities. Because of time and financial limits this method could only have worked by using a small sampling of properties. Such a site-specific procedure could not adequately consider properties that have not been damaged by mining activities, nor properties not within the longwall mining areas. This method was rejected because of its limitations and because it would potentially violate confidentiality agreements between mine operators and home owners.

Method 2. Evaluate all real property sales and assessment data available. By definition, this method would require working with the different data sets to allow a fair comparison of sales and assessments. Similar data sets could be obtained from both counties, which maintain property assessments, assessment appeals, and sales records by tax record number. The tax record number contains a location coordinate (tax map number) that could be used to fix the general location of properties on a map. The maps could then be used to track the relationship of property value to longwall mining.

The average tax map in both counties contains approximately 350 acres and encompasses approximately 50 properties, with the average property containing 10 acres. To maintain privacy, individual properties included in the study would not be located precisely on any map (average location resolution is approximately 3,500 feet – that is, a property can be mapped within about three-quarters of a mile of the actual location). The longwall mines tend to be located in less densely populated areas of the counties. The average tax map in the longwall areas contains nearly 1,000 acres and encompasses approximately 40 properties, with the average property containing 25 acres. The tax map location number in the more rural longwall areas provides an average resolution of approximately 6,000 feet.

This method would rely on statistical analyses of summary data from property sales, county property tax assessments, and assessment appeals.

Method 2 was selected for this study because it protects the privacy of information on specific properties, while providing a comprehensive overview of trends and relationships between property values and longwall mining. Method 2 also provides a baseline of information that can be used in future studies of longwall mining’s effects.

This report presents the results of a comprehensive study of the effects of longwall mining on the value of surface property and on Greene and Washington Counties’ real estate tax bases. The report presents the results of statistical comparisons of sale prices and assessed values in areas overlying longwall panels and control areas without mining (Area Sets). The comparisons were carried out on two area sets in Washington County and three area sets in Greene County.

The report also evaluates the effect that longwall mining has on the rate of coal extraction and the effect the rate of extraction has on tax receipts from coal reserves and mined coal. Finally, the report addresses how tax revenues on longwall coal reserves, insurance claim payments, and coal company settlements offset potential property value losses.

The following questions are addressed:

1. Is there a quantifiable effect on the value of residential surface properties that overlie longwall operations?

A. Is there a relationship between proximity to longwall mining and sales price of properties?

B. Is there a relationship between proximity to longwall mining and assessed value?

C. Are there other factors that influence differences in value and do these factors relate to longwall locations?

2. What taxes are generated by longwall operations and how do they relate to other taxable real estate?

A. How do these taxes offset any gains or losses from homeowners’ taxes?

B. How does longwall mining affect the taxes that coal companies pay on mined coal and the remaining coal reserves?

3. Does longwall mining impact the value of properties scheduled to be undermined?

Among homeowners, some will say that no amount of money can compensate for the fear and worry of one’s home being undermined. Others will say they have been fully compensated, and still others will say their property was not damaged when the longwall passed underneath.

Among the coal operators, some will say that property owners are “made whole” by the payments that compensate for damage and inconvenience. In some cases, these payments exceed the appraised value of the structure in question. In other cases, the operator may have paid the minimum possible, or legal issues may have resulted in delays. In some cases, the operator may deny responsibility.

Using a geographic information system (GIS), this study investigated the relationship of property values to mining, looking specifically at assessed values and at sales of surface properties over a ten-year period. This period corresponds with the availability of data. Where available, data such as county tax assessment files that predate this time span were used as well. Maps of longwall panel development over time and maps of areas mined using room-and-pillar techniques were used to assess the effects on surface properties. Areas where no mining has occurred were used for control, and areas where longwall mining has been announced but has not occurred were studied.

Data for the geographic analysis (GIS coverage) for Greene and Washington Counties include:

► Boundaries of longwall permit areas

► Outlines of all longwall panels and dates of completion

► Boundaries of sewer delivery districts

► Boundaries of water delivery districts

► Center lines of paved roads

► Outlines of all tax maps (1:400 scale tax assessment property maps)

► Addresses of all properties receiving damage compensation from coal companies

► Location of all subsidence insurance claims on file with the DEP Mine Subsidence Insurance program

► Location of all reported subsidence incidents handled by the U.S. Office of Surface Mining and Reclamation

► Boundaries of all closed, abandoned, or depleted mines

► Boundaries of all surface parcels in Greene County

► Digital assessment records for both counties (geocoded to tax maps)

This report is intended to serve as a baseline to analyze property value changes in Greene and Washington Counties. Follow-up research to this report would be a traditional assessment on areas of the counties addressed herein. Such follow-up would serve two purposes: first, as a field verification for the GIS approach used in the study that produced this report, and second, as a test case for improving efficiency of traditional assessment by targeting predefined areas of a county.

Coal remains an essential part of today’s energy production in the United States. More than 90% of the nation’s coal is used to generate electricity. Nationwide, the electric utilities generate 51.4% of all electricity from burning coal (Freme, 2000). All other fuel sources – petroleum, natural gas, nuclear, hydro, wind, solar, and geothermal, combined – generate the remaining 48.6% of electricity used in the residential, commercial, and industrial sectors of the United States. In Pennsylvania, the percentage of electricity generated from coal is even higher – approximately 60%. In 1999, Pennsylvania’s electric utilities produced 96,023,410,000 kilowatt hours of electricity that powered 5,104,483 consumers in the state. Among the consumers, approximately 43% were residential, 26% commercial, and 30% industrial (Energy Information Administration, October 2000).

Although a few room and pillar deep mining operations still are producing coal the primary underground coal mining in Greene and Washington Counties in southwestern Pennsylvania uses the deep-mining technique known as longwall mining. This technique was first developed and extensively used in European coal fields. Introduced into Pennsylvania in 1967, longwall mining has grown in use as the larger coal mining companies apply this more efficient and productive coal extraction technique. Coupled with the highly efficient production rate is simultaneous and ongoing surface subsidence that conflicts with existing surface usage. While the subsidence movements and effects on the surface can largely be predicted, conflicts arise when surface features and structures are involved. While most of the large longwall operations to date have occurred in sparsely populated areas, some recent mine operations, particularly in Washington County, have occurred under populated areas and major roadways.

Extracting coal from tens to hundreds of feet below the surface produces the potential for surface subsidence, regardless of the mining technique used. Mining technique, however, can offer insight into the time frame when subsidence may occur. In room-and-pillar mining, subsidence can occur 30 years or more after a mine is closed – and often abandoned, whereas in longwall mining, subsidence occurs concurrently with mining and in certain circumstances can continue for almost two years. In contrast to room-and-pillar, longwall mining offers government and homeowners the benefit of having an active mine operator on the scene to repair damages.

Wherever rock or mineral is removed from underground, the void created will translate through the overlying bedrock and surficial material. The extent and control of surface movement depends on several factors, including the thickness of the mined coal, the mine geometry and mining methods, and the thickness, rock type (lithology), structure, and hydrology of the overburden (Dunrud, 1984). Much research has been done over the past 30 years in subsidence prediction and mitigation and is discussed in Section 2.3.

The political boundaries of Greene and Washington Counties encompass one of the nation’s most renowned coal seams, the Pittsburgh seam. The Pittsburgh coal seam is a single, persistent bed, with an almost horizontal structure and a thickness of four to ten feet (average six feet) across the two counties. The thickness of the overburden above the seven active longwall mines in the two counties ranges from 380 to 1,150 feet (Fiscor, 2001). The seam’s structure makes it ideal for mining using the longwall technique, and the coal’s lower sulfur content – typically less than two percent in these counties – makes it environmentally and technically desirable for a multitude of uses (Shultz, 1999).

Mining in the Pittsburgh seam began in Greene and Washington Counties more than a century ago where the coal outcropped along the Monongahela River and its tributaries. Despite the extensive mining of the past, the bulk of Pennsylvania coal at present – more than 80 percent – is mined from the Pittsburgh seam. Of the coal mined today, 99 percent of Pittsburgh seam coal is mined in Greene and Washington Counties. Deep mining also occurs in the Sewickley coal seam in southeastern Greene County, but it is minor by comparison (Table 2.2-1).

Table 2.2-1. Coal Production in Bituminous Deep Mines (2000) |

||||||

Coal Seam |

Greene County |

Washington County |

Pennsylvania |

|||

|

Tonnage |

% of PA Total |

Tonnage |

% of PA Total |

Tonnage |

% of PA Total |

Sewickley |

277,872 |

0.48% |

0 |

0.00% |

277,872 |

0.48% |

Pittsburgh |

37,506,037 |

64.18% |

9,283,762 |

15.89% |

47,256,740 |

80.87% |

Other Bituminous |

0 |

0.00% |

0 |

0.00% |

10,903,791 |

18.66% |

Total |

37,783,909 |

64.66% |

9,283,762 |

15.89% |

58,438,403 |

100.00% |

Source: Pennsylvania Department of Environmental Protection, 1999 Annual Report on Mining Activities in the Commonwealth of Pennsylvania, revised June 2000. |

||||||

The methods used for deep mining include conventional room-and-pillar, continuous mining room-and-pillar (with or without retreat mining), and longwall mining. With room-and-pillar mining, there is the possibility of leaving pillars of coal to support overlying structures, but in retreat mining, most pillars are removed. Room-and-pillar mining with retreat removes 80% to 90% of the coal. With longwall mining, continuous mining machines are used to set up the work areas for 1,000-foot-wide panels of coal that extend 10,000 feet or more in length. Within these panels longwall machines have the potential for removing 100% of the coal.

Since the introduction of longwall mining into southwestern Pennsylvania (Gateway Mine) and northern West Virginia in 1970, significant research has been completed to measure and predict the effects of subsidence on surface features and structures. Because longwall mining is designed to remove large blocks of coal completely and leave no coal behind to support the surface, longwall mining results in larger areas of subsidence troughs than conventional room-and-pillar mining. A typical panel of 1,000 feet wide and 10,000 feet long with six feet of coal could affect a surface area of almost 230 acres. Mining of the panel would remove almost 2.5 million tons of coal. Maximum vertical subsidence would occur on the surface along the centerline of this panel and could be in excess of three feet depending on the depth to the coal seam, the rock over the coal seam, and the surface topographic features.

Surface subsidence resulting from longwall coal mining of the Pittsburgh coal seam in Greene and Washington counties, Pennsylvania is affected by various geologic and engineering factors including:

► Thickness of rock over the coal seam (overburden)

► Thickness of the coal seam removed (excavated height)

► Type of rock (lithology) comprising the overburden

► Topography of the surface (surface relief, or variation in elevation and characteristics of land above the coal seam)

► Width of the longwall panel

► Location of the subsided surface in relation to the center and edges of the longwall panel

While all types of subsidence can cause damage to surface features and structures (houses, roads, etc.), the type and severity of damage depends on the forces (stress) that propagate to the surface as the mine roof collapses. These forces may include stretching (tension), squeezing together (compression), and sinking of the ground (vertical displacement). The effects of the forces are measured and studied by developing a subsidence profile, which shows how subsidence would look on a cross-section usually drawn at a right angle to the longwall machine as it moves lengthwise into the panel. The position of a surface structure in relationship to the underlying panel is critical to the severity of damage experienced at the surface.

According to Walker and LaScola (1989):

“It is widely recognized that the vertical displacement associated with subsidence causes little appreciable damage to structures, so long as the magnitude of the movement is uniform across the length of the structure. The most commonly observed damage is caused by the horizontal tensile and compressive strains associated with the bending of the ground. In subsidence engineering, bending of the ground surface is discussed in terms of inclination or tilt, and curvature. When analyzing the stresses on a structure caused by mining, it is necessary to address the stress caused by both the advancing subsidence wave and the development of the subsidence profile.”

Generally, the greatest amount of vertical displacement will occur along the lengthwise centerline of a longwall panel. The U.S. Bureau of Mines observed this phenomenon in a detailed study of longwall mining in the Pittsburgh coal seam in Greene County, Pennsylvania. The seam was 5.5 to 6.0 feet thick and 350 to 900 feet below the surface. It was mined in a 600-foot wide panel. Average subsidence varied from 3.25 feet (3 feet 3 inches) at the center of the panel to 0.41 feet (less than 5 inches) at the edge of the panel. At a distance of 150 feet away from the panel, vertical displacement was 0.05 feet (about one-half inch). Of the 16 monitoring sites used in the Bureau of Mines study, the most pronounced subsidence (4.04 feet) occurred at the center of the widest and shallowest panel (Adamek, V., Jeran, P. W., and Trevits, M. A., 1987).

According to the authors, “structural damage is determined by the extent of the surface deformations...,” which can be measured and predicted using calculations of the following:

1. Differential subsidence (inclination or tilt). This is the vertical distance between two points divided by their horizontal distance apart.

2. Curvature (differential inclination or slope). This is a measure of how the slope or inclination changes by curving or bending of the surface as one moves from the center of a subsidence trough to its edge.

3. Horizontal strains – tension and compression (differential horizontal displacements). Tension causes a lengthening and compression a shortening displacement measured in a horizontal plane. Tension tends to create cracks and compression tends to create bulges in the earth’s surface.

The mechanics of subsidence prediction and analysis are very technical and require engineering and advanced mathematical skills. The reader is referred to the Subsidence Engineers Handbook (National Coal Board, 1975) for additional information.

Exhibit 2.3-1 Subsidence Profiles over Longwall Panel (Adamek et al., 1987)

Exhibit 2.3-1 Subsidence Profiles over Longwall Panel (Adamek et al., 1987)Exhibit 2.3-1 shows an example from the Bureau of Mines study of subsidence and inclination over a 600-foot-wide longwall panel with overburden varying from 700 feet at the center of the panel to 650 feet at the one edge of the panel. At the center of the panel, a maximum subsidence of 3.25 feet was measured with no measurable change in slope. Subsidence (vertical displacement) decreased from the center of the panel to the edges. Inclination or curvature reached maximum levels at the approximate midpoints between the centerline and the panel edges. (Note that inclination was measured in millimeters per meter; one inch equals 25.4 millimeters, and one meter is 3.28 feet or about a yard. Using these conversions, the maximum inclination in this study was less than one inch per yard.)

The study also examined the horizontal displacement created by the subsidence event. Given that the ground sinks from less than an inch at the panel’s edges to 3.25 feet at its centerline, the surface experienced measurable horizontal movement. Exhibit 2.3-2 shows the horizontal displacements observed at the site. Maximum movement was less than 8 inches.

Figure 2.3-2 Horizontal Displacements over Longwall Panel (Adamek et al., 1987)

Figure 2.3-2 Horizontal Displacements over Longwall Panel (Adamek et al., 1987)In summary, the Bureau of Mines study found subsidence along the lengthwise centerline of longwall panels to be a vertical phenomena (3.25 feet on one panel) with no measurable horizontal displacement. At approximate midpoints between the centerline and the panel edges, horizontal displacement was found at its maximum (less than 8 inches for one panel). Surface features and structures above a longwall panel will experience varying levels of stress and subsequent deformation depending on specific location above the panel. Subsidence and deformation depend on:

► Vertical displacement

► Horizontal tension (stretching of the surface)

► Horizontal compression (squeezing of the surface)

Another study by the Bureau of Mines (Fejes, 1986) found that subsidence over 450- to 500-foot wide panels at depths of 800 to 1,500 feet with extraction of 5.9 feet of coal resulted in subsidence at the center of the panel of 1.7 to 2.2 feet (width/depth ratios of 0.4-0.5). Surface deformation was found to continue beyond the panel edge and sometimes resulted in a raising of the surface. According to this study, some subsidence occurred more than a year after the initial subsidence when the panel was mined. The Bureau researchers believe that mining an adjacent panel stimulated the continued subsidence over the mined-out panel for more than 19 months after mining ended. Ground stress associated with the differential subsidence resulted in horizontal movement and damage to surface structures.

The Bureau of Mines also studied a Greene County longwall panel and its related subsidence to learn how subsidence affects well water quantity and quality (Moebs & Barton,1985). Overburden at this site was between 750 and 1,000 feet; the coal removed was approximately 5.5 feet thick. In addition to maximum vertical displacement along the centerline of the panel, the study found:

► An initial subsidence of one-half foot occurred as the longwall face moved beneath the measuring instruments at the surface.

► Subsidence continued at a rate of approximately one-half foot per month until vertical displacement reached a maximum of 3.25 feet at the centerline seven months after undermining.

► Water wells only within the boundaries of the longwall panel showed a precipitous decline as a result of undermining. Water levels were unaffected in wells 500 feet or more beyond the panel boundaries. No evidence was detected of adverse effects on the small streams or springs located within 1,200 feet of the panel.

Another Bureau of Mines analysis (Jeran and Barton, 1985) found that subsidence deformation increases significantly as longwall panel width increases in proportion to coal seam depth. The researchers set up three categories to describe the three conditions of relationship between width and depth, as follows:

► Sub-critical: the panel width is less than the depth of the panel from the surface (for example, a panel is 600 feet wide and 1,000 feet deep).

► Critical: the panel width equals depth from the surface (for example, width and depth are both 1,000 feet).

► Super-critical: the panel width is greater than panel depth (for example, panel width is 600 feet and depth is 500 feet below the surface).

The researchers found that longwall panels wider than their depth (Super-Critical Condition) displayed complex horizontal and vertical surface movements and significant strain on surface features. They concluded:

“The super-critical geometry results in a subsidence curve [cross-section profile] with multiple points of maximum subsidence. The critical case has one point of maximum subsidence. The sub-critical case has a maximum point at its center, but this is less than the maximum possible subsidence.”

In a fifth report from the U.S. Bureau of Mines research, Jeran and Adamek (1988) observed that in the rolling hilly terrain of Greene County, the hillsides were showing significantly more subsidence effects than the valleys. The magnitude and direction of horizontal deformation were increased on hill slopes by soil and rock slumping and moving downslope. These downslope slumps may represent a geologic phenomenon of mass movement where the surface is adjusting to changes in the slope induced by subsidence.

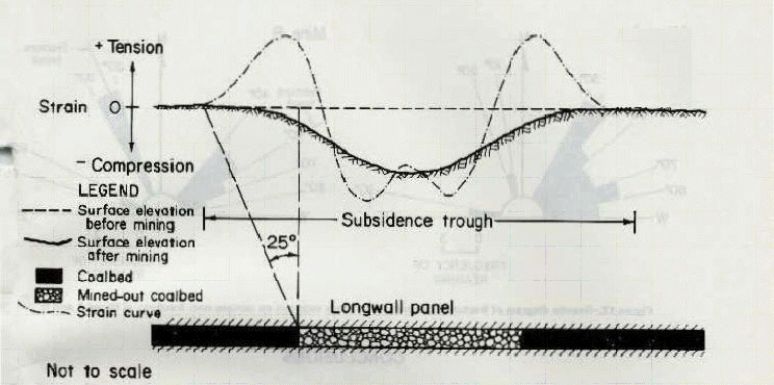

Another Bureau of Mines study completed by Ingram (1989) showed that both the horizontal and the vertical forces of tension and compression move in a wavelike motion along the surface slightly ahead of the advancing longwall face. Exhibits 2.3-3 and 2.3-4, provide a schematic of this process. Exhibit 2.3-3 depicts how the surface is subjected to waves of stretching (tension) and squeezing (compression) as the longwall face passes. The advancing wave creates a tensional force and then changes to a compressional force.

Exhibit 2.3-3 Compression and Tension from Movement of Panel Face (Ingram,

1989); Profile Parallel To the Panel

Exhibit 2.3-3 Compression and Tension from Movement of Panel Face (Ingram,

1989); Profile Parallel To the Panel Exhibit 2.3-4 Compression and Tension over Subsidence Trough (Ingram, 1989);

Exhibit 2.3-4 Compression and Tension over Subsidence Trough (Ingram, 1989);Profile perpendicular to Panel

Exhibit 2.3-4 shows the tensional and compressive wave as the surface subsides over the panel. In a super-critical situation, this wave becomes a complex of overlapping stresses of tension and compression as well as multiple subsidence troughs. Thus, in addition to the vertical and horizontal displacement discussed in earlier Bureau of Mines studies, Ingram identified a different kind of upward movement of the earth’s surface in relation to the wave.

The Bureau of Mines study reported by Walker and LaScola (1989) used four concrete walls to examine the effect on surface structures of vertical and horizontal movement caused by subsidence. The study examined the stress and damage created by a 1,000-foot-wide longwall panel, mining 6 feet of coal below 650 feet of overburden. Three “static” 36 feet long by 4.66 feet high walls (labeled B – midway between centerline and panel edge; C – between B and the panel edge; and D – near panel edge) were placed parallel to the longwall face over the panel at specified distances from the centerline of the panel. A fourth “dynamic” wall, A (86.33 feet long by 4.0 feet high), was placed perpendicular to the longwall face along the centerline of the panel.

After undermining, all four walls were deformed, but none of the three static walls were cracked. Of the static walls, wall B was located across the predicted maximum compression point, and wall D was located across the predicted maximum point of tension; these walls showed the most curvature. Because of location, these walls were subjected to the highest amount of tension and compression resulting from horizontal ground movement. Wall A, which was longer and located parallel to the direction of mining, was cracked into three pieces as the longwall face passed underneath, primarily in response to tensional forces.

The researchers concluded that structures tend to respond to the stresses caused by undermining in a similar manner as the ground. However, the structures respond at varying rates and times. The variations as well as the rigidity of the structures resulted in deformation and damage.

Subsidence research had been performed by the former U.S. Bureau of Mines and various contractors (including Resource Technologies Corporation) for the Bureau of Mines prior to the opening of the Bailey Mine in Richhill Township, Greene County. Some of this published research involved the Pittsburgh coal seam in Greene County, PA, in southwestern Pennsylvania, in general, and in West Virginia.

As early as 1975 Stingelin et al. used the principles of subsidence prediction, as developed in Europe, to modify and apply to U.S. geological conditions. Developed for the anthracite region of northeastern Pennsylvania, the resulting prediction methodology was also tested successfully in the Bituminous coal fields of Pennsylvania and western Maryland. This simplified model gives a prediction of maximum subsidence expected along the centerline of a panel.

Since this and other earlier attempts at mine subsidence prediction, the Bureau of Mines, OSMRE, and university researchers, as shown by the cited selected research publications, have advanced the state-of-the-art in subsidence prediction over longwall panels and in understanding of the nature of the underlying forces. Recent research studies have concentrated on protecting surface structures during a subsidence event. Such principles as the plane-fitting technique have proven to be effective in mitigating the effects of the bending and twisting actions associated with ground subsidence (Peng and Yi Luo, 1994).

Continued research into longwall mining’s effects on the surface features and structures is ongoing by government and university researchers. In a 10-county study area in western Pennsylvania (PADEP, 1999, 2001 – Act 54 reports), the effects of both longwall and room-and-pillar mining on surface structures and features and water resources were studied. Of 15 perennial streams undermined by longwall panels, 9 exhibited pooling conditions, 4 exhibited diminished flow, and 2 exhibited both pooling and diminution. Additional research has been completed and can be seen in the report on streams, wetlands, and riparian areas.

Longwall panel dimensions continue to increase. Since the original Gateway Mine panel configuration in 1970 (460 feet wide and 6,150 feet long), panels have increased dramatically in their dimensions. Currently, panels in the Bailey Mine are 1,100 feet x 10,500 feet. Planned panel dimensions at the New Century Mine in Fallowfield Township, Washington County, Pennsylvania are 850 x 12,500 feet. These increases in panel dimensions raise the fear for potentially increasing surface damage, particularly in more densely populated areas.

In summary, longwall panel width and depth are critical to what happens at the surface. With panel width increasing beyond overburden thickness (depth to the coal seam), super-critical conditions are established. Thus, more extensive surface areas are exposed to potential deformation, and maximum subsidence is more likely to occur at multiple points across a panel. Super-critical conditions with respect to panel width and depth have the potential to increase the extent and severity of surface damage. In contrast, making panel longer will have no effect on the severity of surface subsidence events. Longer panels will increase mine efficiency and economics.

2.4 Pittsburgh Coalbed – A Geologic Description

The Pittsburgh coalbed was deposited over a period of several million years during the geologic time period known as the late Pennsylvanian, which ended about 286 million years ago. The coalbed was formed in a large basin that included all of Greene County and much of Washington County. It is the most extensive and economically important coalbed in the region. The basin axis passed through Washington and Greene Counties and a calcareous, or limey, shale was generally deposited over the coal-forming swamp. Clastic deltaic deposits (sand, silt, and mud) were introduced from the southeast and northwest. The deposits created a roof above the Pittsburgh coal that is most commonly alternating thinly bedded, dark gray to black, fissile, carbonaceous shale, coal stringers, and sandstone lenses, often called “draw slate.” The draw slate is generally less than 4 feet thick (McCulloch et al, 1975).

The rock layers above the coal and draw slate (overburden) are predominantly interbedded limestone, shale, and siltstone. Sandstone is generally present in eastern areas, manifesting itself as channel sandstone and as sandstone cutouts of the coal seam. The rock type (lithology) of the overburden plays an important role in the severity of surface subsidence, particularly in Washington County where thickness of the overburden is less than that encountered southwestward as the Pittsburgh seam plunges deeper along a synclinal axis (USGS OFR 97-864).

The Pittsburgh coal, although variable in thickness, maintains a persistent four to eight foot minable thickness throughout the area and is most commonly five to six feet thick. The coal generally thickens southward where it reaches a maximum of 16 feet or more in southeastern Greene County. The coal generally occurs as a main seam and roof coal with a shale (draw slate) parting.

Quality is an important factor of the Pittsburgh seam. The Pittsburgh coal has shown the following ranges in chemical analyses (Keystone Coal Industry Manual -1982, p. 6l4, for Greene County (dry-ash free basis):

Sulfur 0.8-3.2% |

Ash 4.2-10.8% |

Btu/lb 13,040-14,140 |

Moisture 1.7-3.7% |

Volatile Matter 33.0-36.4% |

Fixed Carbon 52.2-57.3% |

Ash Fusion Temp 2,110-2,620F |

|

The Pittsburgh coal has a market for steam generation used in powering electricity-producing turbines. Where the sulfur content is below 1.5 percent (washed), the coal meets metallurgical specifications for sulfur (1.3-1.4%), ash (5.0-6.0%), and free swelling index (7.5-8.0). Because of the decrease in demand for metallurgical coal, much of this metallurgical reserve will eventually be used as steam coal. Most of the metallurgical-grade reserves are in the eastern areas of Washington and Greene Counties where they were heavily exploited in the past by room-and-pillar deep mining.

2.5 Status of Longwall Mining in Southwestern Pennsylvania

Current Pittsburgh seam longwall mining status in Washington and Greene Counties, PA as reported in Coal Age (2002) is summarized in Table 2.5-1. This includes the Blacksville No. 2 Mine that has its entry in West Virginia but is mining predominantly in Greene County, Pennsylvania. Mon-View Mining’s Mathies mine was shut in early 2002. Maple Creek Mine and Dilworth Mine are scheduled for closings in late 2002, and the High Quality Mine is scheduled to initiate operations in 2003

In addition to these active longwall mines, longwall activity occurred in three additional mines now included in the mined-out areas on the accompanying exhibits of current and past mining activity in Greene and Washington Counties, Pennsylvania. These mines are Blacksville No. 1, Humphrey No. 7, and Gateway. The location and permitted extent of these mines are shown in Exhibit 2.5-1, Exhibit 2.5-2 and Exhibit 2.5-3.

Table 2.5-1 Active Longwall Mines in Southwestern Pennsylvania (Pittsburgh Seam) |

|||||

Mine |

Seam (Inches) |

Cut Height (Inches) |

Panel Width (Feet) |

Panel Length (Feet) |

Overburden (Feet) |

Bailey 1 |

62-72 |

62-72 |

1,100 |

10,500 |

600 - 1,000 |

Bailey 2 |

62-72 |

62-72 |

1,000 |

9,000 |

600 -1,000 |

Blacksville No 2 |

78 |

74 |

1,000 |

10,000 |

850 - 1,150 |

Cumberland |

78-84 |

78-84 |

930 |

10,500 |

750 - 1,050 |

Dilworth |

76-80 |

76-80 |

1,020 |

5,000 |

500 - 800 |

Mine No. 84 |

90 |

68 |

1,100 |

9,000 |

500 - 750 |

Emerald No 1 |

72-84 |

72-84 |

984 |

9000 - 12000 |

380 - 950 |

Enlow Fork 1 |

68-72 |

68-72 |

1,000 |

9,000 |

600 - 1,000 |

Enlow Fork 2 |

68-72 |

68-72 |

1,000 |

9,000 |

600 - 1,000 |

Maple Creek |

67 |

67 |

850 |

5,000 |

400 - 500 |

High Quality |

62 |

62 |

850 |

12,500 |

400 - 600 |

Exhibit 2.5-1 Current Longwall (red or gray panels) and Past Pittsburgh Seam

Mining (Blue) in Greene and Washington Counties

Exhibit 2.5-1 Current Longwall (red or gray panels) and Past Pittsburgh Seam

Mining (Blue) in Greene and Washington CountiesA larger scale map of longwall and past room-and-pillar mines in Greene County is shown in Exhibit 2.5-2. This is followed by a similar map for Washington County (Exhibit 2.5-3).

Exhibit 2.5-2 Current Longwall (red or gray panels) and Past Pittsburgh

Seam Mining (blue) in Greene County, Pennsylvania

Exhibit 2.5-2 Current Longwall (red or gray panels) and Past Pittsburgh

Seam Mining (blue) in Greene County, Pennsylvania

Exhibit 2.5-3: Current Mining Permits (red), Longwall Panels (blue), and

past Pittsburgh Seam Mining (light blue) in Washington County,

Pennsylvania.

Exhibit 2.5-3: Current Mining Permits (red), Longwall Panels (blue), and

past Pittsburgh Seam Mining (light blue) in Washington County,

Pennsylvania.

The data used to complete this study came from a variety of sources:

► PADEP Act 54 database (8/94-8/98)

► PADEP claims database (McMurray)

► PADEP Mine Subsidence Insurance database (Harrisburg)

► PADEP six-month mine map repository & database

► OSMRE mine map repository (abandoned mine lands)

► OSMRE database on subsidence mitigation

► Consol Energy database on damage claims & payments/repairs

► RAG database on damage claims & payments/repairs

► PA Coal Association data & library resources

► Tri-State Citizens Mining Network (headquartered in Washington County)

► County tax assessment databases (re: changes in assessment values)

► County tax assessment databases (re: tax revenue from coal mining)

► County recorders of deeds databases (re: property sales information over study period)

► Historic records of national property value trends over time (inflation)

► Anecdotal records from media sources

► RTC GIS database on mining activity

The most important data considered for both Washington and Greene Counties is listed below:

• Current and historical mining maps for insertion into a GIS

• Coal company data pertaining to property settlements

• Parcel and tax index maps

• Tax roll information for the last 10 years

• Maps of infrastructure such as sewer and water

• PADEP subsidence claims database

• OSMRE emergency subsidence claims

Resource Technologies Corporation (RTC) has developed and maintains a geographic information system (GIS) identifying mining activity in Washington and Greene Counties. RTC has maps of mined-out longwall panels, mined-out room-and-pillar mines, previous surface and deep mining, and current active mining permits. Much of these data are derived for DEP and coal company maps. The database associated with the mines contains information such as date of mining, size of the mine, volume of coal, and production history.

To learn whether homeowners are being compensated for damages due to longwall mining, RTC sought and obtained coal company data on settlements. These data were aggregated to a tax index map scale to protect privacy and maintain confidentiality.

A GIS is a computer-based system that allows for simultaneous analysis of many layers of map data, such as the relationship of underground mining to overlying surface property. In addition, a GIS permits analysis of associated tabular data, such as county assessment information with map data. Using a GIS system to relate property information to mining information is relatively easy. Essential to the process is the conversion of all data to the same map base and relational database structure. RTC completed the conversion of all county assessment records, mine maps, and tax index maps as part of the contract with DEP to perform this study. With the exception of the coal company compensation records, the maps and record bases are now part of the public record.

The pertinent aspects of the coal company compensation records were made available to this project under a confidentiality agreement. The agreement stipulated that the data could be used only in an aggregated form (tax map location rather than specific address). This procedure was necessary to satisfy the confidentiality requirements contained in various agreements between the coal companies and various surface owners. In Washington County, the tax index maps were digitized from paper base maps. In Greene County, a digital version of tax index maps was created by aggregating individual parcels into tax map groupings. In both counties, historic tax assessment change records had to be reconstructed from the annual data stored digitally on computer tapes.

Although this project is based on the scale of tax index maps, it was desirable to use individual parcel maps during the analysis phase of the project. The greater detail of parcel location leads to greater accuracy using the GIS approach. For example, the parcel map was laid on the mining map to identify which properties could potentially be affected by longwall mining. Exhibit 3-1 shows how surface maps were assigned to the longwall panels. Properties whose major portions did not overlie a panel were not identified as longwall properties

The parcel map for Greene County was acquired from the county. This permitted RTC to identify individual properties that could be affected by longwall mining. However, in Washington County, only the tax index maps were available. RTC had to consider that every property in an index map containing longwall mining could be affected by the mining, even though only a small portion of the index map may have a longwall panel in it. This is because the locations of the individual properties within the index map are not known.

Tax roll information was obtained from both counties over a period of about 10 years. This information was used to track whether property values changed from year to year, and if longwall mining influenced these changes. In Washington County, 12 years worth of tax data, from 1991-2002 were available. In Greene County, only 1993-1997, 2000, and 2001 were available. Data was interpolated between 1997 and 2000.

The methods of using these data are described in the sections below.

4.0 SALE AND COUNTY VALUE OF LONGWALL AND NON-LONGWALL PROPERTIES

Differences in property value based on proximity to longwall mining were analyzed for this study. Properties above longwall mining were compared to similar properties not affected by longwall mining. Comparing sales data and county value data, RTC found no statistically significant correlation between the presence of longwall mining and general or average property values. Other factors such as access to infrastructure such as public sewer and water, remoteness of site (land use density), and proximity to a roadway have more pronounced relationships to value than proximity to mining.

4.2 Sale and County Value Comparisons

The following objective from the Project Work Statement was addressed:

Using areas of appropriate size and composition, obtain and compare the fair market values of surface properties above longwall mines and the fair market values of surface properties in control areas to determine if there is a statistically significant difference between the two groups.

In addressing this objective, RTC realized that the available data sets would not allow an analysis of “fair market” value in the strict sense of the word. As used in the appraisal industry, fair market value is defined as an estimate of current monetary value of a property, including all tangible and intangible assets, assuming that a willing and competent buyer, with full knowledge of all pertinent characteristics and possible uses of the asset, without undue pressure or duress to motivate the purchase, would purchase the asset from a willing and competent seller, who also possesses full knowledge of all pertinent characteristics and uses and, without undue pressure or duress to motivate the sale of the asset, would sell the property.

To solve the dilemma of assigning value for the analyses, RTC converted the county assessed values of all relevant properties to an estimated market value, and named the resulting estimate the “county value.” The county value was calculated by dividing the assessed value from the county records by the county’s common level ratio. Common level ratio is a number calculated by the state Department of Revenue and used to make sure Pennsylvania’s property transfer taxes are equitable across the state. Each county in the state has a common level ratio calculated annually on the basis of property sales in that county. By dividing assessed value by the common level ratio, an estimate of market value can be calculated. This county value estimate may be different from the fair market value a willing buyer will pay a willing seller for a property.

Therefore, analyses for Sections 4 and 5 of this report use the calculated county value, which is an estimate of market value and may not be the same as actual fair market value.

Control groups of properties in areas where no longwall mining had occurred were identified within each county. The control groups were used to compare properties with similar characteristics, such as house size, access to roads, access to public sewer and water, to see whether differences in county value could be attributed solely to longwall mining. Five longwall and five control non-longwall groups of properties were selected for the study.

4.2.2 Control Area Selection Methodology

The following methodology was used to select mine areas and associated control areas for study:

1. Longwall mine study areas were selected from current mine maps. Maps were obtained from the DEP and confirmed with mining companies. Mine maps were registered to the Greene County and Washington County map base. All panels were digitized into the GIS system and the panel completion dates were included in the tabulated data attached to each mapped panel (Exhibit 4.2.2-1).

2. Abandoned and closed conventional underground mine areas were mapped. Each mined area was identified by mine, operator name, and type of mining.

3. Proposed mining areas were identified from existing mine plans obtained from DEP and the longwall mining companies.

4. Basic coal geology was mapped. Geologic information was limited to depth and seam thickness.

Exhibit 4.2.2-1 A Portion of the Study Area Showing Longwall Panels and Completion Dates

(black), Abandoned Mine (orange crosshatch), Permitted Mining (red), Greene County Parcels

(green), and Washington County Tax Index Maps (blue).

Exhibit 4.2.2-1 A Portion of the Study Area Showing Longwall Panels and Completion Dates

(black), Abandoned Mine (orange crosshatch), Permitted Mining (red), Greene County Parcels

(green), and Washington County Tax Index Maps (blue).5. All property tax parcels in Greene County were mapped. The data file attached to each mapped parcel includes current assessed value, size, extent of structural improvements, sale price, deed number, last known transfer, owner name, location address, access to utilities, appeals history.

6. Digital versions of Washington County’s paper tax index maps were created in the GIS, but digital maps of individual property tax parcels were not created.

Exhibit 4.2.2-2 Base Map of County Tax Index Maps (black) and Township

Boundaries (blue)

Exhibit 4.2.2-2 Base Map of County Tax Index Maps (black) and Township

Boundaries (blue)Records in the county’s tax assessment database were associated with the appropriate tax index map. The average Washington County tax index area represents 350 acres, although some encompass as few as 10 acres and a couple as many as 1,200 acres. In Greene County, the average tax index map is 1,500 acres, the maximum is 5,000 acres, and the minimum is 1 acre. On average, a property located by tax index map is estimated to be within 1,500 feet of its real map location. The Washington County data included similar attributes as the Greene County data files, such as current assessed value, size, extent of structural improvements, sale price, deed number, last known transfer, owner name, location address, access to utilities, appeals history..

Exhibit 4.2.2-4

Exhibit 4.2.2-4 Exhibit 4.2.2-3

Exhibit 4.2.2-37. A base map of all tax index maps (combining Greene and Washington Counties) was created (Exhibit 4.2.2-2). The average size of each tax index area (called a map polygon) in the combined base map is 350 acres. The average map polygon contains 50 property tax parcels. In urban areas, the density is higher (more than 500 parcels per map polygon) and the map index areas are smaller (10 acres or less). No longwall panels are located under urban areas in either county. In rural and remote regions of the counties, the map polygons represent more land area (up to 1,750 acres) and fewer property tax parcels (less than 35). Longwall mines tend to be located in remote and rural areas of the counties. The distribution of sizes and density of property tax parcels are shown in Exhibit 4.2.2-3 and 4.2.2-4.

8. Areas with public sewer and water were digitally mapped using county supplied maps (an example is shown in Exhibit 4.2.2-5).

Exhibit 4.2.2-5 A Portion of Greene County Showing

Areas with Public Sewer and Water (blue) and Sewer

Delivery Zones (red) over Tax Index Maps (black).

Exhibit 4.2.2-5 A Portion of Greene County Showing

Areas with Public Sewer and Water (blue) and Sewer

Delivery Zones (red) over Tax Index Maps (black).9. All state numbered highways were mapped. Each parcel and/or index map location that is within ½ mile of a road was attributed as such.

10. Areas (polygons) surrounding the longwall panels but within existing mine subsidence permits were analyzed to identify basic characteristics: depth to coal, density of surface development, public sewer and water delivery areas, road accessibility, and relationship to abandoned mining.

11. Control group areas where longwall mining has not occurred were selected to closely match the properties in longwall study areas. Each control area was selected to represent similar characteristics with each related longwall group, as follows:

• size (geographic area)

• land use (density of parcels and structures)

• historical mining

• access to infrastructure (length of public sewer and water lines, number of roads)

• surface characteristics, topography, density of streams

For both counties, all surface properties with their associated assessments, sales, and tax index maps were assigned to a control area, a mine area, or an “outside” area (neither control nor mine). All analyses and comparisons were performed on these consistent assignments. The control and mine areas were identified as Greene East, Greene Central, Greene West, Washington East, and Washington West (Exhibit 4.2.2-6) and are associated with the following longwall mining:

• Greene East: CONSOL Dilworth Mine

• Greene Central: RAG Emerald and Cumberland Mines

• Greene West: CONSOL Bailey and Enlow Fork Complex

• Washington East: Maple Creek, New Century, and 84 Mines

• Washington West: CONSOL Enlow Fork complex

12. The average density of land use (improved parcels per square mile) was

calculated from the GIS data. Using a natural break analysis, a grid of the study area (both counties) was developed. Density ranges for the grid were assigned as follows:

Exhibit 4.2.2-6 Matched Analysis Study

Areas with Longwall Mining (Mine) and

Related Control Areas without Longwall

Mining

Exhibit 4.2.2-6 Matched Analysis Study

Areas with Longwall Mining (Mine) and

Related Control Areas without Longwall

Mining

• Remote (less than 50 improved parcels per square mile)

• Rural (less than 500 improved parcels per square mile)

• Suburban (less than 2,000 improved parcels per square mile)

• Urban (more than 2,000 improved parcels per square mile)

Exhibit 4.2.2-7 provides an overview of the tax index map density throughout two counties. Density was an important factor used to select the control (no-longwall) comparison areas. Table 4.2.2-1 counts the number of index map areas classified as remote, rural, or suburban by mine and control areas.

Sewer and water service delivery areas are shown in Exhibit 4.2.2-8. Table 4.2.2-2 counts the number of index map areas with and without public sewer and water services in the mine and control areas.

Exhibit 4.2.2-7: Image of study area showing roads,

color grid of parcels per square mile, mining areas and

control areas.

Exhibit 4.2.2-7: Image of study area showing roads,

color grid of parcels per square mile, mining areas and

control areas.

Table 4.2.2-1: Land Use Density by Analysis Area |

||||

Analysis Control Area |

Count of Tax Maps Classified |

|||

Density |

Total |

|||

Remote |

Rural |

Suburban |

||

Control |

653 |

68 |

41 |

762 |

Mine |

500 |

63 |

43 |

606 |

Outside |

38 |

9 |

9 |

56 |

Total |

1191 |

140 |

93 |

1424 |

Exhibit 4.2.2-8: Sewer and water delivery service areas

Exhibit 4.2.2-8: Sewer and water delivery service areasTable 4.2.2-2: Utilities by Analysis Area |

|||

Analysis Area |

Count of Tax Maps |

||

Utility Status |

Total |

||

None |

Public Services |

||

Control |

634 |

150 |

784 |

Mine |

427 |

157 |

584 |

Outside |

29 |

27 |

56 |

Total |

1090 |

334 |

1424 |

If proximity to longwall mining negatively affects property value and if properties are consistently assessed by the county assessment departments, then properties in longwall areas should be consistently assessed less than similar properties in the companion control areas. To test this hypothesis, the “county estimate of value” of all properties within each of the areas was aggregated to the tax index map level for each of three property types (residential, agricultural, and other [industrial/commercial]):

• building: average (mean) value and median value

• land: average (mean) value and median value

• total: average (mean) value and median value

Total value is estimated from the county assessed value by dividing the assessed value by the county common level ratio (a time adjusted or corrected version of the assessment rate). For example, if the assessed value of a property is $20,000 and the common level ratio for the county is 0.25, the calculated estimate of property value would be $80,000, which RTC calls the “county value” for the express purpose of comparison in this study. To compare properties, the unit value (or value per acre) was calculated for each parcel and for each index map area. The following examples illustrate the math:

Example |

A |

B |

C |

D |

E |

Assessed Value (as shown on County Records) |

Common Level (Assessment) Ratio |

Calculated County Value (A÷B) |

Size of Parcel: Acres (As shown in County Records) |

County Value/ Acre (C÷D) |

|

1 |

$20,000 |

.25 |

$80,000 |

0.5 |

$160,000 |

2 |

$30,000 |

.3 |

$100,000 |

0.75 |

$133,333 |

3 |

$100,000 |

.25 |

$400,000 |

4.0 |

$100,000 |

The Geographic attributes were assigned to each parcel and each tax index map as follows:

• Located in Control Area, Mine (longwall), or Other (Outside of Mine or Control)

• Access (2000 feet) to

• Public Sewer and Water

• Public Sewer and private water

• Public Water and private sewer